Shaka Checking FAQs

Meet Shaka, Hawaii's first digital bank account.

Shaka by CPB is Hawai‘i’s first and best 100% digital checking account. Shaka was made for people who love the flexibility of banking online, the simplicity of paying their bills digitally, and the convenience of not having to visit a branch.

Since Shaka is all-digital, it offers benefits unlike any other checking account:

- Bank 100% online

- Access direct deposit paychecks up to two days early

- Get among the highest checking interest rates in Hawaii

- Use any ATM, and you will get $20 of ATM fees a month on us

- Get a checking account with no monthly fees when you sign up for online statements

Shaka Checking FAQs

Meet Shaka, Hawaii's first digital bank account.

Shaka by CPB is Hawai‘i’s first and best 100% digital checking account. Shaka was made for people who love the flexibility of banking online, the simplicity of paying their bills digitally, and the convenience of not having to visit a branch.

Since Shaka is all-digital, it offers benefits unlike any other checking account:

- Bank 100% online

- Access direct deposit paychecks up to two days early

- Get among the highest checking interest rates in Hawaii

- Use any ATM, and you will get $20 of ATM fees a month on us

- Get a checking account with no monthly fees when you sign up for online statements

General

Shaka by CPB is Hawai‘i’s first and best 100% digital checking account. Shaka was made for people who love the flexibility of banking online, the simplicity of paying their bills digitally, and the convenience of not having to visit a branch.

Since Shaka is all-digital, it offers benefits unlike any other checking account:

- Bank 100% online

- Access direct deposit paychecks up to two days early

- Get among the highest checking interest rates in Hawaii

- Use any ATM, and you will get $20 of ATM fees a month on us

- Get a checking account with no monthly fees when you sign up for online statements

Since Shaka is designed to be 100% digital, there is a $2 branch transaction fee for conducting a teller transaction on your account except for cashier’s checks, wires and foreign currency exchange. If you enjoy stopping in at your neighborhood CPB branch or writing checks, explore other checking options here.

Call the Central Pacific Bank Customer Service Center to get a new Shaka debit card. It will take about ten business days to arrive to you by mail.

Opening an Account

To make things stress-free, Shaka accounts can be opened online and in a branch. For more information visit cpb.bank/shaka or visit any CPB branch location.

Yes! Shaka accounts can be opened online and in a branch. For more information visit cpb.bank/shaka or visit any CPB branch location.

Anyone who loves the convenience of banking online and qualifies can apply for a Shaka account.

100% Online Account

Shaka is designed for our new digital lifestyle. Every service can be accessed online:

- Apply online

- View Online statements

- Deposit checks through our app

- Set up Bill Pay and/or transfer money

- Check balances

- All account servicing can be done by online chat, secure message, or by calling our Customer Service Center

Since this is a 100% digital account, you can manage all your banking online. All account services can be done by online chat, secure message, or by calling our Customer Service Center. Yes, you can use a branch, but there is a branch transaction fee of $2 per transaction (deposit or withdrawal). For instance, a deposit transaction that consisted of three checks will be assessed as one $2 fee.

There are no teller withdrawal fees for cashier’s checks, wires or foreign currency exchange in branches.

All of your statements are available online. Customers will be placed automatically in online statements if you have online or mobile banking, otherwise a $5 monthly fee will apply.

Since Shaka is designed to be 100% digital and banking online is much better that in line. You will not receive checks for this account and if you pay all your bills online, this is the checking account for you.

Early Paycheck Feature

After your online application is approved and your account is ready, you have an option to switch your direct deposit online. This process is simple as you just need to follow the instructions to search for your employer or payroll provider. Once you select your provider, you will need to sign into your employer or payroll provider account to verify your identity. Once you confirm details, you should be set.

If you choose to set up direct deposit later or if your employer or payroll provider is not found, you can submit a direct deposit request by filling out this form and providing to your employer. Download direct deposit form.

To enjoy this the early paycheck feature, your employer or benefit provider must send your payroll by ACH to your Account and include the key phrases “Payroll” or “Direct Deposit” within the transaction description. Transactions without these key phrases in the description, or with unrecognized abbreviations of these phrases, will be processed as normal and will not be given the early paycheck benefit. We do not determine the transaction description.

Direct deposit times may vary, depending on when CPB gets the payment file from your employer. Unfortunately, CPB has no control over when we get payment from your employer. We will process your payment as soon as we can. We generally make funds available on the day we receive the file.

ATM Fee Reimbursement Feature

There is no charge for using Central Pacific Bank ATMs. If you use another non-network ATM, Shaka members can enjoy up to $20.00 in ATM surcharge rebates per billing cycle. There is no limit on the number of ATM transactions or the individual surcharge amount per transaction.

Non-CPB ATM transactions:

- Domestic ATM cash withdrawals, $3 each

- International ATM cash withdrawals, $5 each

- Balance inquiries and transfers, $1 each

Shaka repays up to $20 of non-CPB ATM surcharges per month. You’ll see your credit for these fees at the end of your monthly billing cycle once surcharges are added up. Any other surcharge fees over $20 will be charged to your account.

Reward Interest

A Shaka checking account is among the highest reward interest rate in Hawaii if you meet these simple conditions:

- You must have 15 debit card point of sale transactions totaling $75+ each month

- Direct deposit of $25+ each month

A Shaka checking account is among the highest reward interest rate in Hawaii if you meet these simple conditions:

- You must have 15 debit card point of sale transactions totaling $75+ each month

- Direct deposit of $25+ each month

You will still earn the base rate interest.

See detailed rates.

Current Customers

Unfortunately, existing accounts cannot be converted or transferred to a new Shaka account. Customers can open a separate Shaka account or close their existing account and open a new Shaka account.

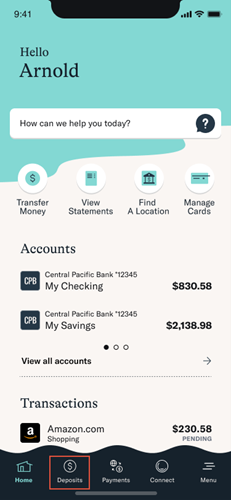

Yes, your Shaka account will appear in both your current online banking and mobile banking accounts.

Yes, existing debit cards can be linked to your Shaka Checking debit card. If you want your point of sale transactions to count towards your Shaka Checking reward interest, you must designate Shaka as your primary account.

Statements

You can access your statements 24/7 online and download and print them if needed. Customers will be placed automatically in online statements if you have online or mobile banking, otherwise a $5 fee will apply. Enrolling is easy and takes only a few mins. Enroll Now

Navigate to Accounts then select Statements from the dropdown menu.

A list of all accounts eligible for online statements will be presented; eStatements will be pre-selected. Click Next.

Review the confirmation page which will display your statement delivery preference. Click Enroll.

You can view your statements once logged in to digital banking.

- From a web browser, navigate to “Accounts,” then select “Statements” from the dropdown menu.

- Click “View Statement” for your current statement or View History for past statements.

- From the mobile banking app, click the “View Statements” icon on your dashboard.

- Click “View Statement” for your current statement or “View History” for past statements.

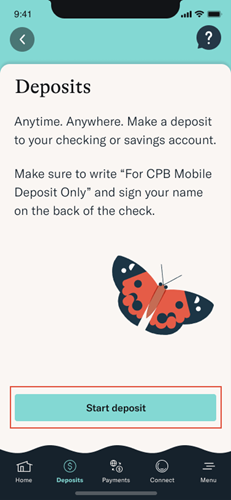

Mobile Check Deposit

Depositing a check is simple. Open the app and select deposit.

Select Start Deposit to start the process.

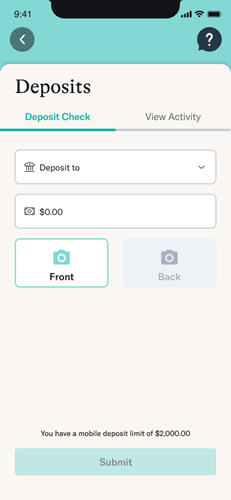

Select the account you want to deposit too. Add the amount and take a picture of the front and back of the check.

You will need to take a picture of the check on a dark background.

Click Submit to deposit the check.

- You can deposit up to $10,000 per day and up to $30,000 per month

- There is a $10,000 maximum amount per check

- You can deposit as many checks as you like, as long as you stay within our deposit requirements

The new mobile banking app was designed to only work in portrait mode. Unfortunately, landscape mode is not currently available.

Bill Pay & Zelle

- Select “Pay Bills” from the navigation. Review and agree to the Terms & Conditions.

- Add a Company or Person from the mobile app:

- Click “Add a New Biller.”

- From the dropdown menu, select whether you want to add a company or person. Input the information of the biller and click “Add.”

- Add a Company or Person from the browser:

-

- Click “Add a Company or Person.”

- To add a company, use the search bar to look up the company or input the company information directly. You can also look for the business you’d like to add by choosing a category button.

- To add a person, toggle to “Person” using the tab menu and enter the person's information.

- To enroll in Zelle, select “Send Money with Zelle” from the navigation. Review and agree to the Terms & Conditions.

- Click the “Enroll” button and complete the enrollment process.

To add a contact using the mobile app:

- Go to the “Send Money with Zelle® page.

- Click “Settings” listed with the gear icon on the right side of the screen.

- Click the “Contacts” button.

- Click the “Add a New Contact” button.

- Input your new contact’s First Name, Last Name, and either their email, phone number, or bank account info.

- Click “Save” to add the contact.

To add a contact when accessing from a browser:

- Go to the “Send Money” with Zelle® page.

- Click the “Add a New Contact” button.

- Input your new contact’s First Name, Last Name, and either their email, phone number, or bank account info.

- Click “Save” to add the contact.

Payments are received quickly, typically within minutes, when:

- You send money to a recipient’s email address or mobile number that is registered with Zelle®.

- You send money to a bank account that is eligible to receive payments in minutes.

Payments sent to an email address or mobile number that isn’t registered with Zelle® may take 1-3 business days after the recipient registers or be received on the delivery date, whichever is later.

No. With our new digital banking, there’s no cost to use Zelle®.