Insight Topics

Your go-to source for financial education.

Offering expert insights on a variety of topics such as home affordability, small business growth, international economic trends, and digital banking.

Explore more topics

September 09, 2025

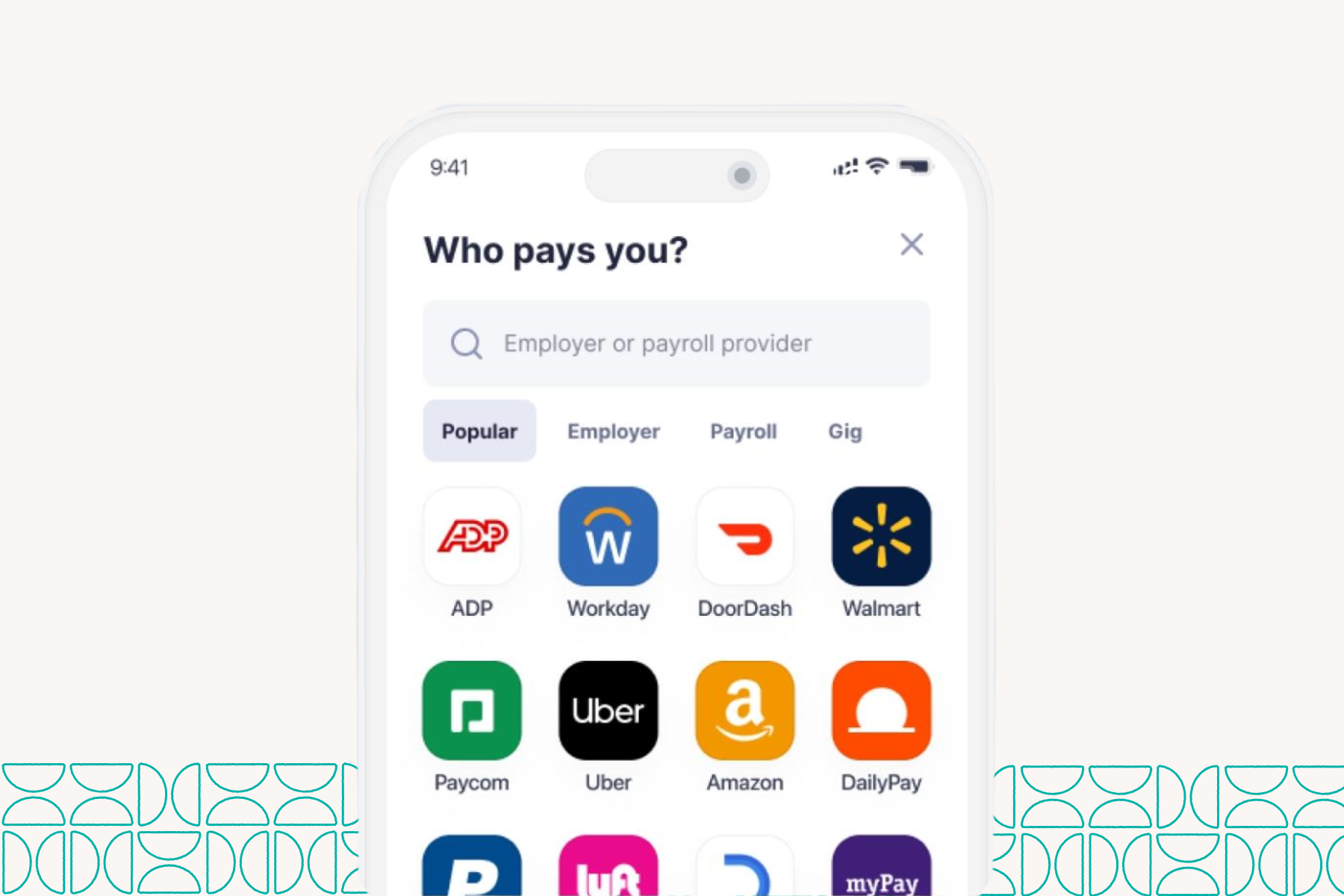

Three New Ways to Bank Better with the CPB Mobile APP

At Central Pacific Bank, we are always looking for ways to make your banking experience easier and more convenient. Our latest mobile app updates add three powerful features to help you stay on top of your finances and manage your money with ease.

August 26, 2025

Calculating and reducing your cash burn rate

Your cash burn rate is a key financial metric that shows how quickly you’re using your cash reserves over a specific period. This is crucial if you're in the early stages of your business, seeking investment, expanding, or operating at a loss.

August 26, 2025

Five key considerations in a crisis

Every business is unique, and the challenges it faces during a crisis can vary widely. That’s why it’s crucial to document the steps you’ve taken before reaching out to support organizations. By doing so, you’ll provide them with valuable context that will help them understand your situation better and offer more targeted assistance moving forward.

August 26, 2025

Back to College? 3 Tips to Manage Your Money Smarter This Semester

Heading back to college is exciting, but it can also be expensive. From tuition and books to late-night pizza runs, it’s easy for costs to add up fast. The good news?

June 24, 2025

Protecting Our Kupuna: What to Know About Elder Fraud

No one deserves to be taken advantage of – but sadly, older adults are often the targets of increasingly sophisticated scams. Criminals use tactics designed to manipulate trust, create urgency, and gain access to money or personal information.

June 20, 2025

Webinar | AI Small Business Webinar

Cathy Camp, Executive Vice President of Real Estate atCentral Pacific Bank, moderated a webinar focusing on Unlock Commerical Real Estate Success. The discussion delved into key aspects such as choosing the right professional, bank financing considerations, and SBA 504 loan program (HEDCO).