Resources

Resources

5 Steps to Creating a Budget You Actually Stick to in the New Year

Creating a budget is one thing – sticking to it is another. As we step into a new year, getting your finances organized can set you up for a stress-free and successful future. With the right tools and a clear plan, managing your money becomes less about restriction and more about aligning your spending with your goals.

Here’s how to build a budget that works for you – and how Central Pacific Bank’s digital banking services can help.

1. Set Realistic Goals

Start by defining what you want to achieve. Are you saving for a big trip, a home, or just hoping to cut unnecessary expenses? Break your goals down into short-term and long-term categories. This gives your budget a purpose, making it easier to follow.

2. Understand Your Cash Flow

Knowing exactly how much money is coming in and going out is essential. Review your income and expenses over the last three months to get a clear picture of your spending habits.

CPB Tip: Our mobile app tracks your spending and provides real-time insights into your cash flow. It can even help visualize your spending trends, allowing you to see where your money goes each month. This overview is key to understanding how much you can realistically save or reallocate to different goals.

3. Create Spending Categories Based on Habits

Divide your expenses into essentials (rent, groceries, utilities) and non-essentials (entertainment, dining out). Instead of guessing, use past spending data to build realistic spending categories. This method helps create a budget that reflects your lifestyle and is easier to maintain.

CPB Tip: Our app can analyze your spending habits over the past 90 days and help you create a budget that aligns with your real-life expenses. The automated insights make it simple to categorize expenses and set realistic spending limits that you can stick to.

4. Automate Savings

Treat your savings like any other bill. Automate transfers to your savings account each payday. Even small amounts add up over time, creating a financial cushion for future goals or unexpected expenses.

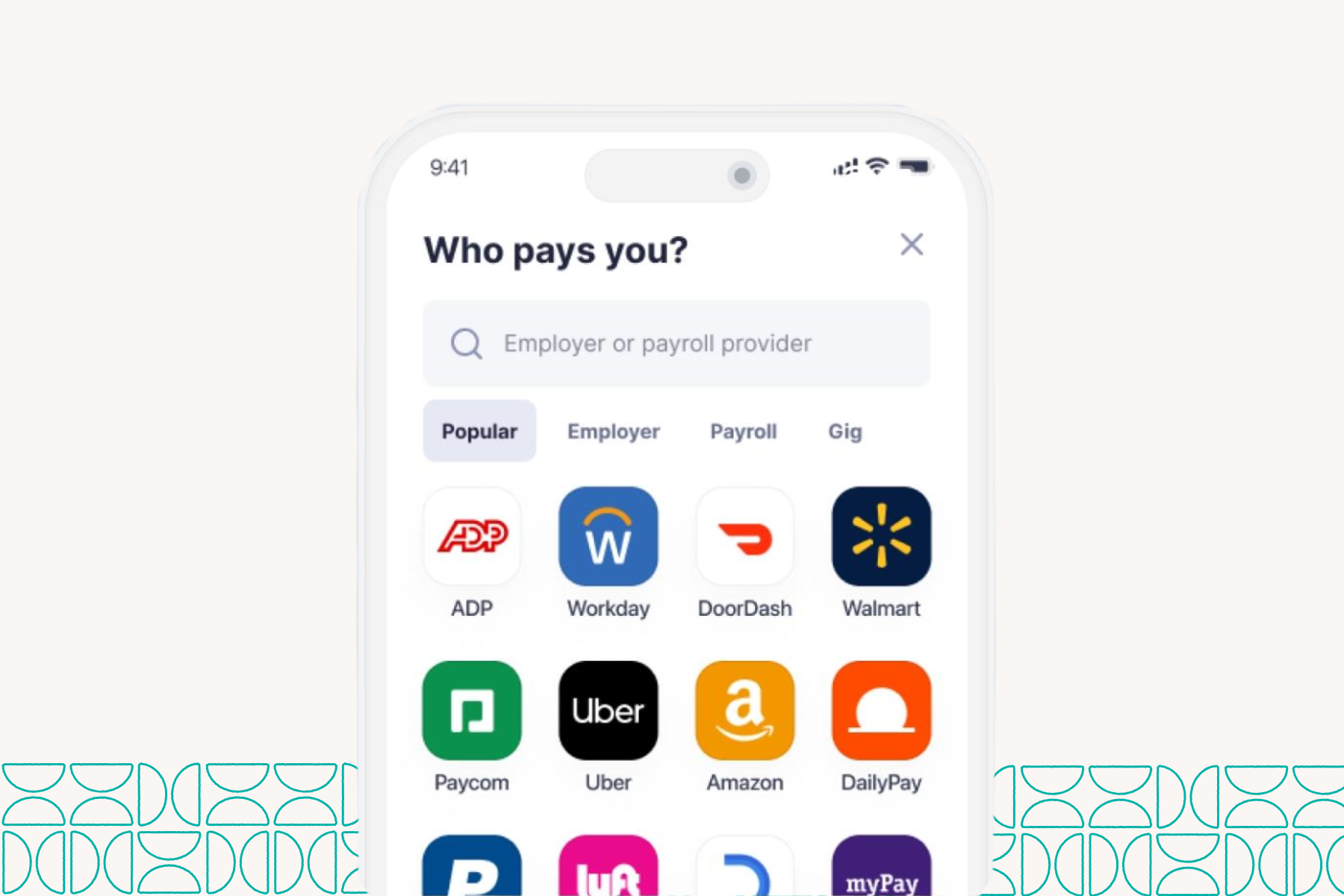

CPB Tip: With CPB’s digital banking, you can schedule recurring transfers, ensuring that saving becomes second nature. You can even split deposits between accounts, directing a portion of your paycheck into savings automatically.

5. Review and Adjust Monthly

A budget isn’t set in stone. Life changes, and so should your financial plan. Take a few minutes each month to review your progress and make adjustments as needed.

CPB Tip: Our mobile app’s budgeting tools not only track your spending but allow you to adjust your budget categories in real-time. By monitoring patterns and making small tweaks, you stay on track no matter what life throws at you.

With CPB’s digital banking tools, budgeting feels less like a chore and more like a lifestyle upgrade. The ability to visualize your spending, automate savings, and create customized budgets based on actual habits takes the guesswork out of financial planning.

Ready to start the new year with a financial plan you can stick to? Download the Central Pacific Bank app today and take control of your money.

Offering expert insights on a variety of topics such as home affordability, small business growth, international economic trends, and digital banking.

Share

Share